are aclu contributions tax deductible

Therefore most of the lobbying activity done by the ACLU and discussed in this Web site is done by the American Civil Liberties Union. And Thin Ice is correct - no court in the.

Are Credit Card Fees Tax Deductible Discover The Truth

The ACLU locks in in administrative campaigning.

. Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And In The Streets 501c3 Tax Deductible Donation Letter Check More At Https Nationalgriefawarenessday Com 505 Donation Letter Donation Letter Template Donation Thank You Letter. Gifts to the ACLU Foundation are fully tax-deductible to the donor.

Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. As an organization thats qualified to get commitments that are tax-deductible by the supporter government law limits the degree to which the ACLU Foundations.

You can read all about it on this page of the ACLUs website. It is the membership organization and you have to be a member to get your trusty ACLU card. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds.

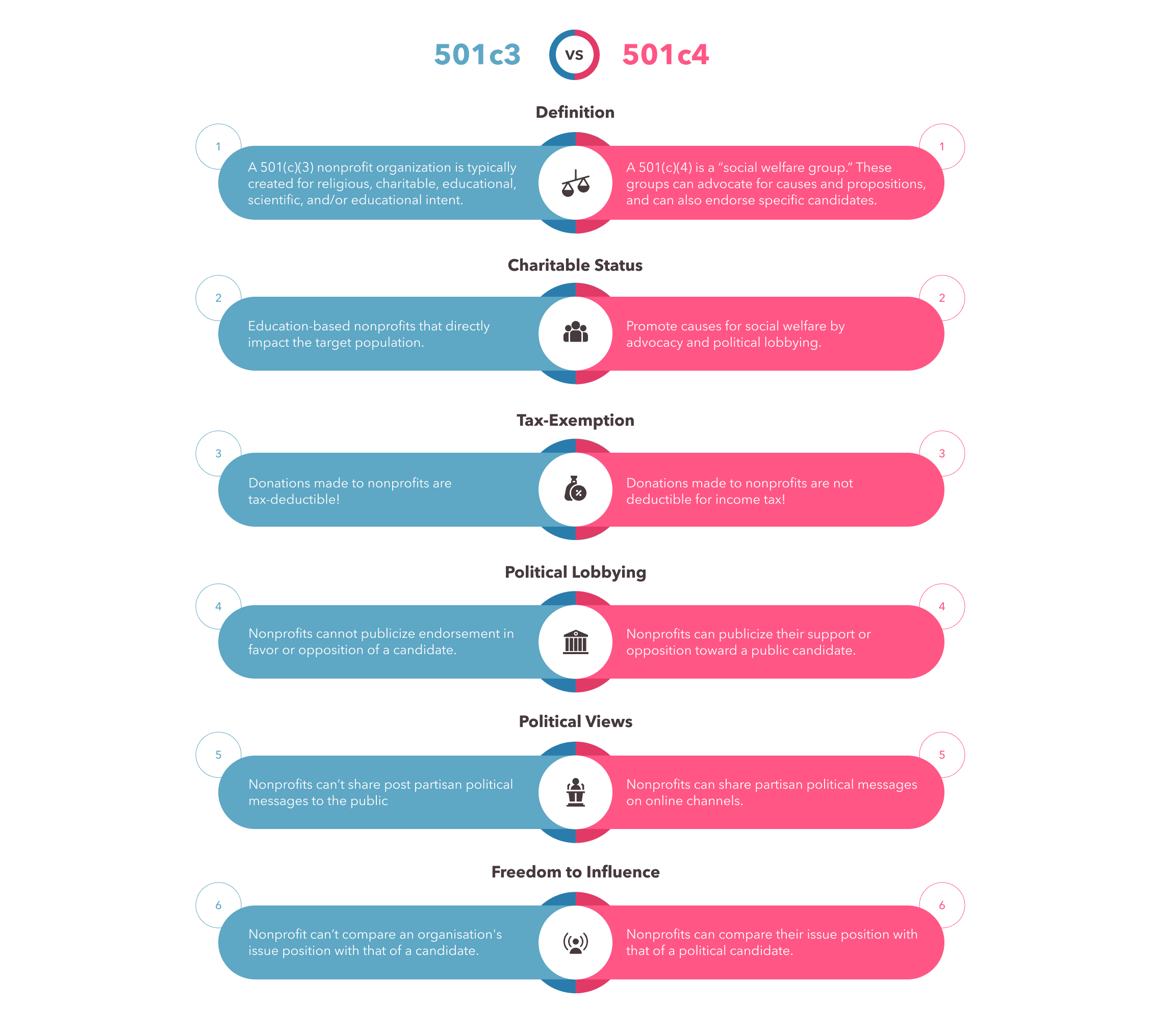

As other answers have noted the ACLU proper is a tax-exempt organization per section 501 c4 of the Internal Revenue Code. Now more than ever we need you by our side. Make a Tax-Deductible Gift to the ACLU Foundation.

As an organization that is eligible to receive contributions that are tax-deductible by the contributor federal law limits the extent to which the ACLU Foundations may engage in lobbying activities. The American Civil Liberties Union is a 501 a tax-exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore nottaxdeductible. Making a gift to the ACLU via a wire transfer allows you to have an immediate.

Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. Membership contributions always fund the Union. The ACLU Foundation of Maryland is a 501 c 3 charity which means that contributions are tax-deductible and cannot be used for political lobbying.

Gifts to the Foundation fund our litigation communications advocacy and public education efforts in Maryland and across the country. They also enable us to advocate and lobby in legislatures at the federal and local level to advance civil liberties. A donor may make a tax-deductible gift only to the ACLU Foundation.

It is the membership organization and you have to be a member to get your trusty ACLU card. You can read all about it on this page of the ACLUs website. ACLU monies fund our legislative lobbying--important work that cannot be supported by tax.

Make a tax-deductible. Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible.

Over the past year the ACLU has fought against a resurgent wave of extremism in all 50 states. While not tax deductible they advance our extensive litigation communications and public education programs. If you donate to the ACLU you will not receive a ACLU tax deduction but if you donate to the ACLU Foundation you may receive a ACLU tax deductionaa.

The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the American Civil Liberties Union. Membership dues and other gifts to the American Civil Liberties Union are not tax deductible.

These organizations are not considered to be charitable organizations under the regulations - that section of the Code is 501 c3 - and therefore contributions made to the ACLU are not deductible as charitable contributions. When you make a contribution to the ACLU you become a card-carrying member who takes a stand for civil liberties.

Aclu Donations How To Make A Tax Deductible Gift Money

Sample Donation Receipt Template Free Documents Pdf Word Letter Donation Letter Donation Letter Template Letter Templates

Give American Civil Liberties Union

Give American Civil Liberties Union

Are Credit Card Fees Tax Deductible Discover The Truth

Don T Let The Tax Grinch Spoil Clients Charitable Giving

Free Business Expense Spreadsheet And Self Employed Business Tax Deduction Sheet A Success Of Your Business Tax Deductions Business Tax Business Expense

Pin By Wan M On Politics History Current Events Global Dod Family Separation Make A Donation Supportive

Income Tax Deduction Table Section 80 Tax Deductions Income Tax Income Tax Return

Tax Deductible Donation Receipt Template Using The Donation Receipt Template And Its Uses Donation Rece Receipt Template Letter Template Word Donation Form

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Tax Deductible Bequest Language American Civil Liberties Union

A Tax Deduction To Make More Off That Rental Property

Harrison Browne Hbrowne24 Twitter

Donate To The Aspca And Help Animals Aspca Animal Donations Animals